Accounting For Product Warranty Costs Under An Assurance Type Warranty

Charges an expense account when the seller performs in b. When the warranty period for the product expires the vendor or manufacturer is no longer liable for any defects.

Provision For Warranty Journal Entry Example Accountinguide

These two conditions are part of the FASBs Statement of Financial Accounting Standards No.

Accounting for product warranty costs under an assurance type warranty. FRS 115 provides more guidance on accounting for warranties. According to the new revenue recognition guidance sellers or companies must distinguish between assurance and service. If the company can reasonably estimate the amount of warranty claims likely to arise under the policy it should accrue an expense that reflects the cost of these.

Units sold the percentage that will be replaced within the warranty period and the cost of replacement. The latter approach is considered to be more correct accounting since all. Which of the following best describes the accounting for assurance-type warranty costs.

Assurance-type warranties those are warranties that promise to customer that the delivered product is as specified in the contract and will work as specified in the contract. These types of warranties are accounted for as warranty obligations and are accrued in accordance with ASC 460-10 which details the accounting for guarantees. This amount may be charged to expense only when warranty costs are incurred or it may be set up as an allowance where a standard amount is charged to expense each month.

Charges an expense account when the seller performs in compliance with the warranty. These warranties do NOT give rise to a separate performance obligation and you account just a provision for warranty repairs under IAS 37. Accounting for product warranty costs under an assurance-type warranty ________.

Under the new revenue recognition guidance entities must distinguish between warranties representing assurance of a products performance and service-type warranties. Usually there are two types of warranties to be accounted for. It defines warranties by.

An estimated expense and liability are recognized at the time of. According to US GAAP ASC 606 as below. A is required for income tax purposes.

Is frequently justified on the basis of expediency when warranty costs are immaterial. Accounting For Product Warranty Costs Under An Assurance Type Warranty A Is Course Hero The buyer receives this warranty as part of the purchase price. Warranties that provide a customer with assurance that the related product will function as the parties intended because it complies with.

Accounting for product warranty costs under an assurance-type warranty a. The accounting treatment varies depending upon the type of warranty. To record the warranty expense we need to know three things.

A warranty is a service-type. Product warranty cost is the charge to expense when a product is replaced under a warranty program. Compliance with the warranty.

Accounting for product warranty costs under an assurance-type warranty a. Overview of Warranty Accounting. In accounting for warranties cash rebates the collectability of receivables.

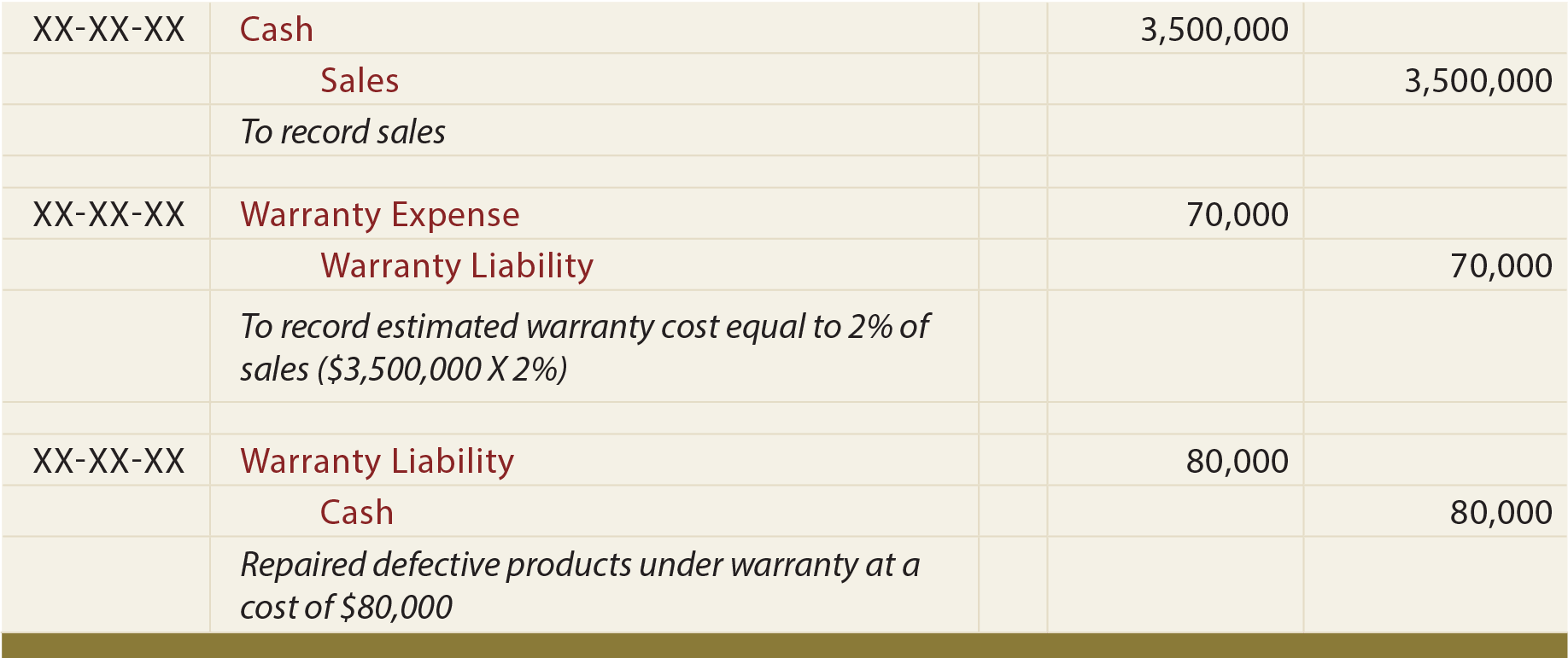

From an accounting perspective according to the Financial Accounting Standards Board FASB warranty expenses should be recognized when they are probable and can be estimated. Accounting for product warranty costs under an assurance-type warranty a. In 2013 the company sold 25000 water bottles.

Such warranties do not give rise to a special obligatory clause and these are considered as a provision for expense in books of accounts. Charges an expense account when the seller performs in compliance with thewarranty. In terms of accounting such a warranty is called assurance-kind of warranties regulated under the IFRS 15 and IAS 37.

Assurance warranties would continue to be accounted for under the cost-accrual guidance in Accounting Standards Codification ASC 460 Guarantees. B charges an expense account when the seller performs in compliance with the warranty. A business may have a warranty policy under which it promises customers to repair or replace certain types of damage to its products within a certain number of days following the sale date.

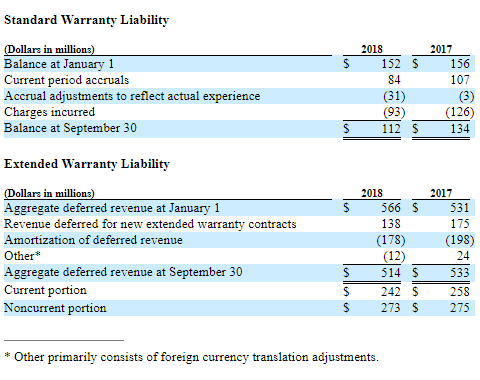

Accounting for product warranty costs under an assurance-type warranty represents accepted practice and should be used whenever the warranty is an integral and inseparable part of the sale. Once the liability is recorded it should be adjusted as changes in estimates occur with the. Because warranty estimates are forecasts that are based on the best available informationmostly historical claims experienceclaims costs may differ from amounts provided How does a company record and report contingencies such as product warranties.

5 Accounting for Contingencies. Is required for federal income tax purposes. In addition to the standard warranty businesses often sell a separate extended warranty for an.

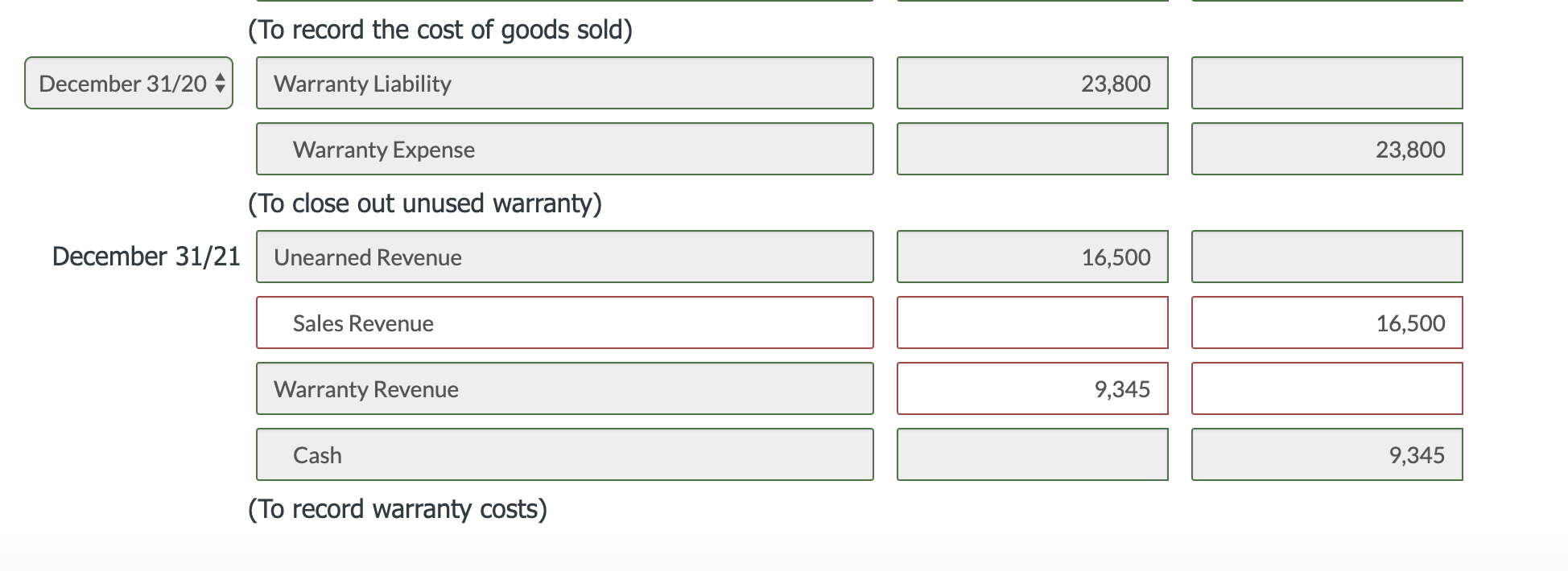

The accounting for that first year is the same as just demonstrated. Is frequently justified on the basis of expediency when warranty costs are immaterialc. Warranties that provide the customer with a service.

Is required for income tax purposesb. Our tutorial on warranty costs discussed the situation where a business makes a sale to a customer and includes in the product purchase price a standard warranty which allows the customer to have the product repaired or replaced if it is found to be defective within a certain period of time. A product warranty liability and warranty expense should be recorded at the time the product is sold if it is probable that customers will be making claims under the warranty and the amount can be estimated.

Each water bottle costs 4 to produce. Is frequently justified on the basis of expediency when warranty costs are immaterial. Extended warranty cost 600 Term 30 months Monthly expense 60030 20 Extended warranty account balance 400 Current asset 20 x 12 240 Long term asset 400 - 240 160 Obviously if the asset is disposed of before the extended fixed assets warranty has expired then the balance on the extended warranty account cannot be treated as an asset and must be transferred to.

Record the amount of warranty expense that the company should record for 2013. C is frequently justified on the basis of expediency when warranty costs are immaterial.

Warranty Expense Warranty Expense Tax Treatment

Accounting For Warranties Expense Approach Revenue Approach Rev 2020 Youtube

Intermediate Accounting Seventeenth Edition Kieso Weygandt Warfield Chapter

Asc 606 Causes Warranty Accounting Changes 20 December 2018

Warranty Costs Double Entry Bookkeeping

Warranty Expense Overview Recognition How To Calculate

Accounting For Warranty Definition Types Journal Entry And More Wikiaccounting

Sales Warranties Correct Option Ifrs 15 Or Ias 37 Complete Explanation Annual Reporting

Recording Transactions Related To Product Warranties Financial Accounting

Pdf Product Reliability And Warranty An Overview And Future Research

Pdf Product Reliability And Warranty Period As A Cost Forming Factors

Solved On January 1 2020 Oriole Ltd Sold On Account 1 400 Chegg Com

Contingent Liabilities Principlesofaccounting Com

Extended Warranty Accounting Double Entry Bookkeeping

Contingent Liabilities Principlesofaccounting Com

Ifrs 15 Revenue From Contracts With Customers Table

Warranty Expense Warranty Liability Journal Entries Youtube

Pdf Product Reliability And Warranty An Overview And Future Research

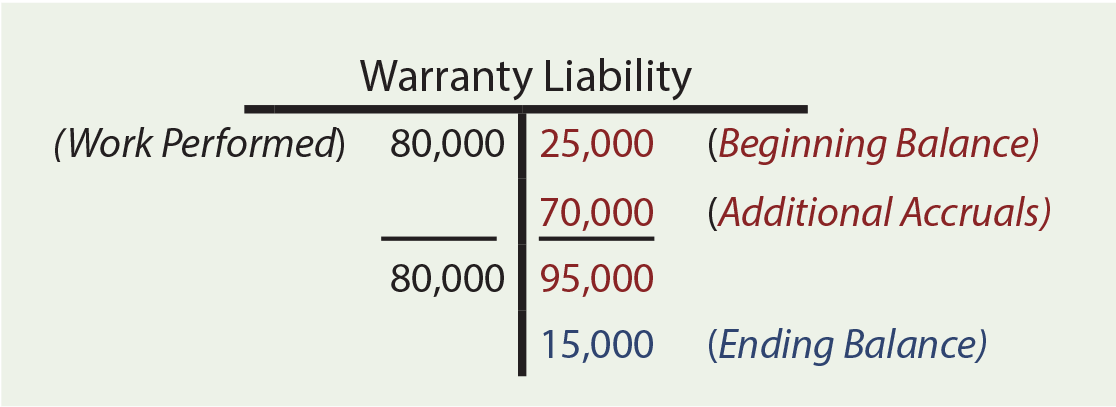

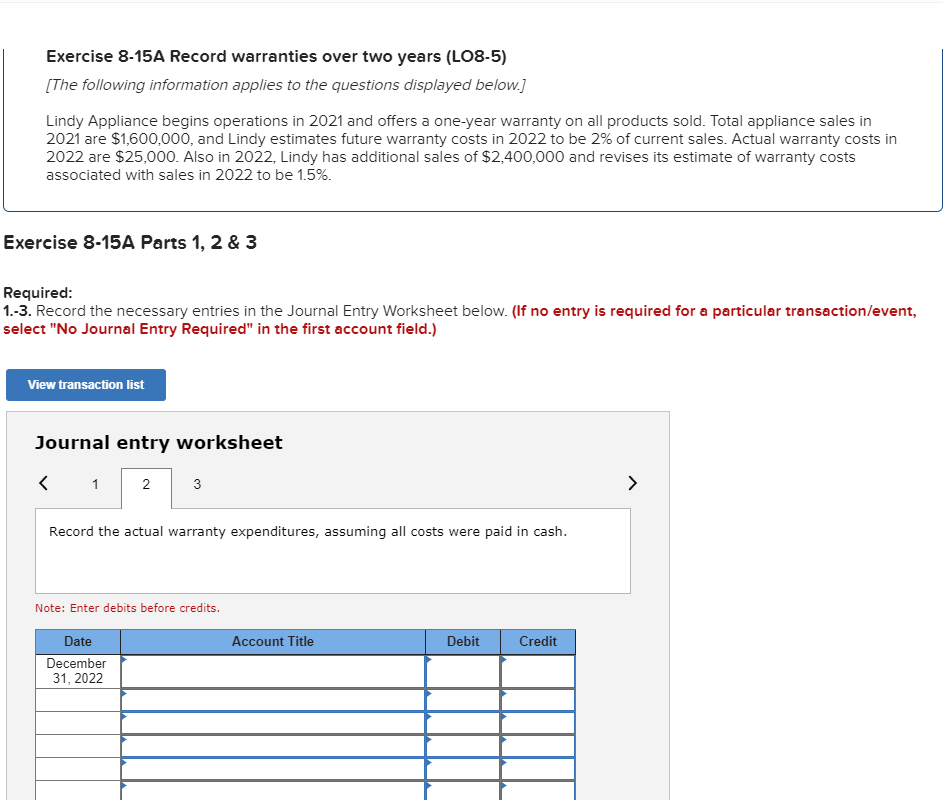

Solved Exercise 8 15a Record Warranties Over Two Years Chegg Com

Posting Komentar untuk "Accounting For Product Warranty Costs Under An Assurance Type Warranty"