Sum Insured And Sum Assured Difference

Sum assured is unique to life insurance policies and term insurance policies as they offer a. It is a pre-defined benefit that the insurer pays to the policyholder in case the insured event takes place.

Rules Of Maximum Sum Assured Calculation Download Table

The sum assured is offered by life insurance companies and the sum insured is generally offered by non-life insurance companies such as health or car insurance companies The sum assured is calculated based on the HLV while the sum insured is paid as per the value of the asset such as in the case of a car insurance plan the sum insured will be determined as per the damages incurred by the.

Sum insured and sum assured difference. The Sum Insured figure is always higher than the BDV to cover you against the rise in building materials or inflation over the period of insurance. To underline the difference first we will understand the two terms separately. Sum assured is the pre-fixed amount a nominee receives on death of the life insurance policyholder.

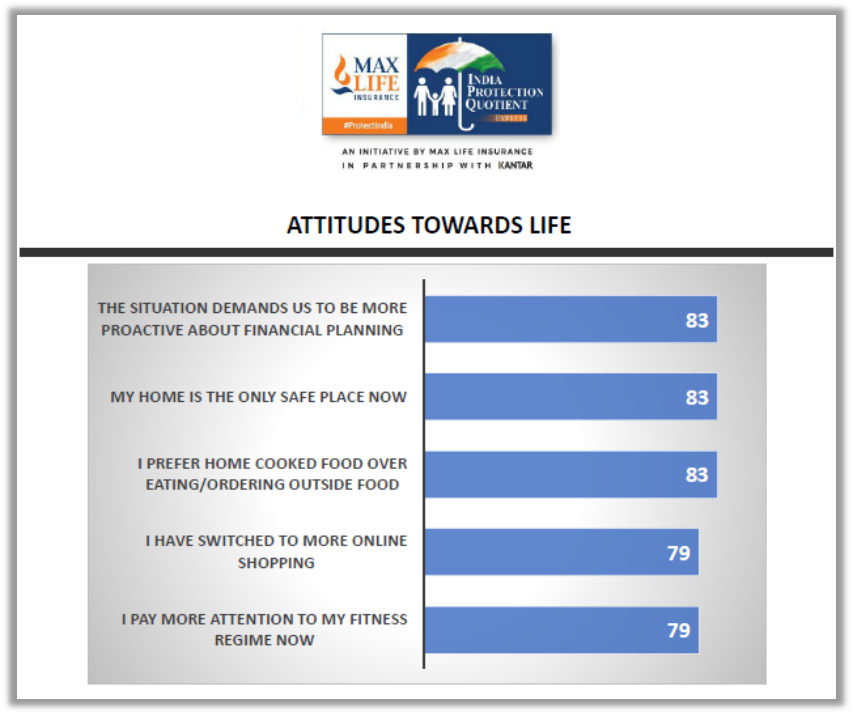

Understanding The Difference Between Sum Assured And Sum Insured Published On Dec 04 2020 530 AM By Sakshi Aggarwal With the costs of healthcare skyrocketing in recent years more and more Indians are becoming aware of the benefits of having health insurance. Sum assured is a pre-decided amount that the insurance company pays to the policyholder when the insured event takes place. The Declared Value is simply the cost to rebuild your property in full however you do not need to add.

Sum Assured is a pre-decided amount that is paid by the insurer to you when the insured event happens. Aapale Channel Mahadev Maske Is sum assured the same as sum insured. Answer 1 of 3.

For instance in a life insurance policy the insurer promises to pay the. While a sum assured defines the benefit sum insured only reimburses. The sum insured correlates directly to the amount of premium you pay but not always to the propertys actual value or.

Let us understand the difference between Sum Assured vs Sum Insured. For example when you buy a life insurance policy the insurer. It is a pre-defined benefit that the insurer pays to the policyholder in case the insured event takes place.

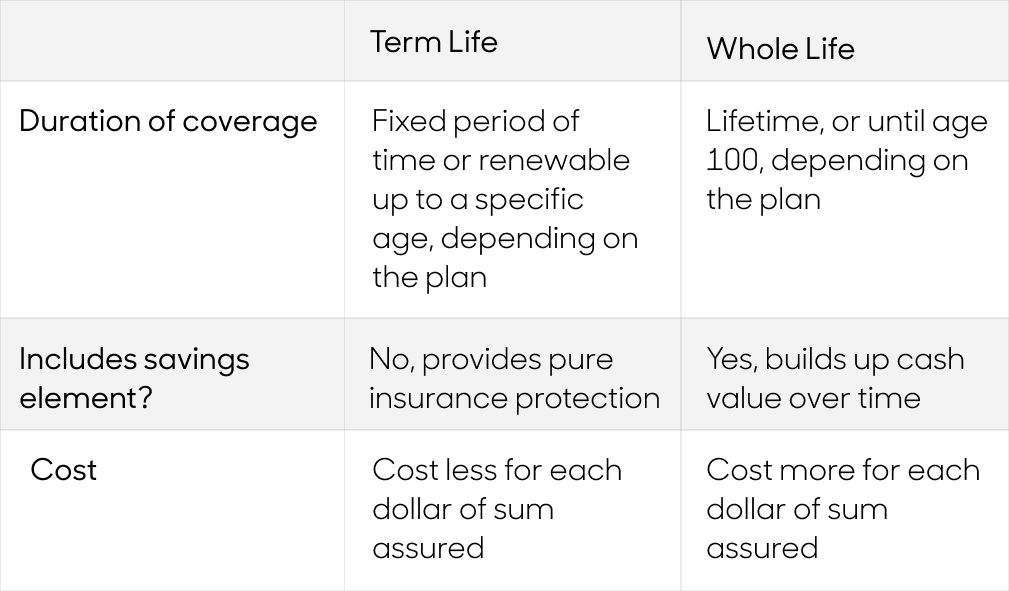

Sum insured and sum assured are among the fundamental terms that an individual essentially needs to understand before choosing a life insurance planThe two terms are the basis on which a plan is evaluated. A very technical part of the policy is the difference between sum assured and sum insured. This amount remains unchanged and is applicable only to life insurance policies.

It is that fixed amount that the insurer pays the policyholder in case of an eventuality. All you need to know. Sum assured is a pre-fixed amount given by your insurance provider either to you or to your nominee in your absence.

The Sum Assured term is usually used in life insurance policies in which. Sum assured and sum insured though seem to mean almost the same are different concepts in insurance. While a sum assured defines the benefit sum insured only reimburses the insured loss.

Sum assured is a pre-decided payout that the insurance company pays to the policyholder if the insured event mentioned in the policy occurs. For instance if you have taken a policy with a sum assured of Rs15 lakhs your nominee will be given the assured sum if something happens to you. Sum Insured is the amount paid as compensation equal to the actual loss incurred by you.

In money back policies the some part of money is refunded to life insured. It basically is based on the principle of indemnity that provides a reimbursement compensation to damageloss. Though on the face of it the difference lies in only two alphabets in principle the two terms have very different meanings.

Sum assured is the value applied to Life insurance policies. The following table of differences will help you understand the concepts of sum insured and sum assured in health insurance. This term is commonly associated with homeowners or property insurance but can also apply to other types of insurance.

Usually the entire sum assured is paid against one claim ie. Meanings of both the term is considered same only difference is that sum insured wit reference to property and assets where as sum assured is. The value of the sum assured depends upon various factors such as age income assets liabilities expected working.

Sum assured is the fixed amount that shall be paid on occurrence or non-occurrence of a particular event. The period is generally is of 5 years and at the time of maturity. Sum insured is the amount of money that an insurance company is obligated to cover in the event of a covered loss.

The difference between these two figures is simply how the insurance contract handles inflation during the insured period. Sum assured is a lump sum payout. Key Difference Sum Assured vs Sum Insured.

The money which is. On the last day of the policy the price of bricks may have seen a rise of 15 as forecasted for 2017 since the policy start date and the BDV value you provided on day one of the policy could be far lower than the actual rebuilding. Difference between sum assured and sum insured.

Sum insured is the maximum amount received in case the insured event happens. Though a novice might interpret the sum assured and sum insured to mean the same their actual meanings are significantly different. Though on the face of it the difference lies in only two alphabets in principle the two terms have very different meanings.

Concept of Sum Insured Vs Sum Assured. What Does Sum Insured Mean. Now these may look and sound alike but are totally different in reality.

Sum insured is the value applied to Non-life insurance. Multiple claims can be made until the sum insured gets exhausted. What is the difference between assured and insuredWhat is sum insuredWhat is t.

Your Policy schedule will often show two values one referred to as the Declared Value and the other as the Sum Insured.

Classes Of Insurance Policies Ebookskenya

Difference Between Insurance Assurance Youtube

Whole Life Insurance Plans For Foreigners In Singapore Factors To Consider Axa Singapore

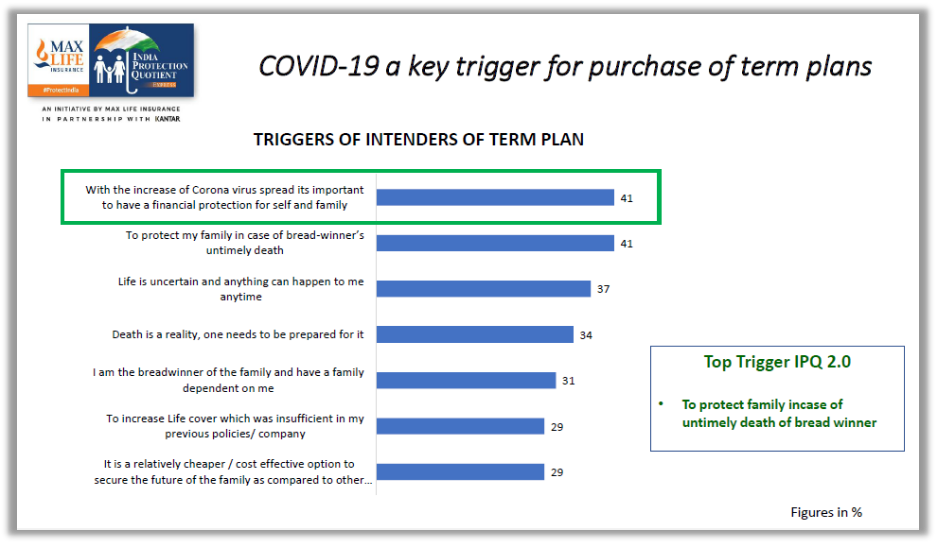

How To Choose The Right Sum Assured Under A Term Plan Max Life Insurance

How To Calculate The Sum Assured And Premium Of Life Insurance Abc Of Money

How To Pick A Right Family Floater Health Insurance Policy Businesstoday

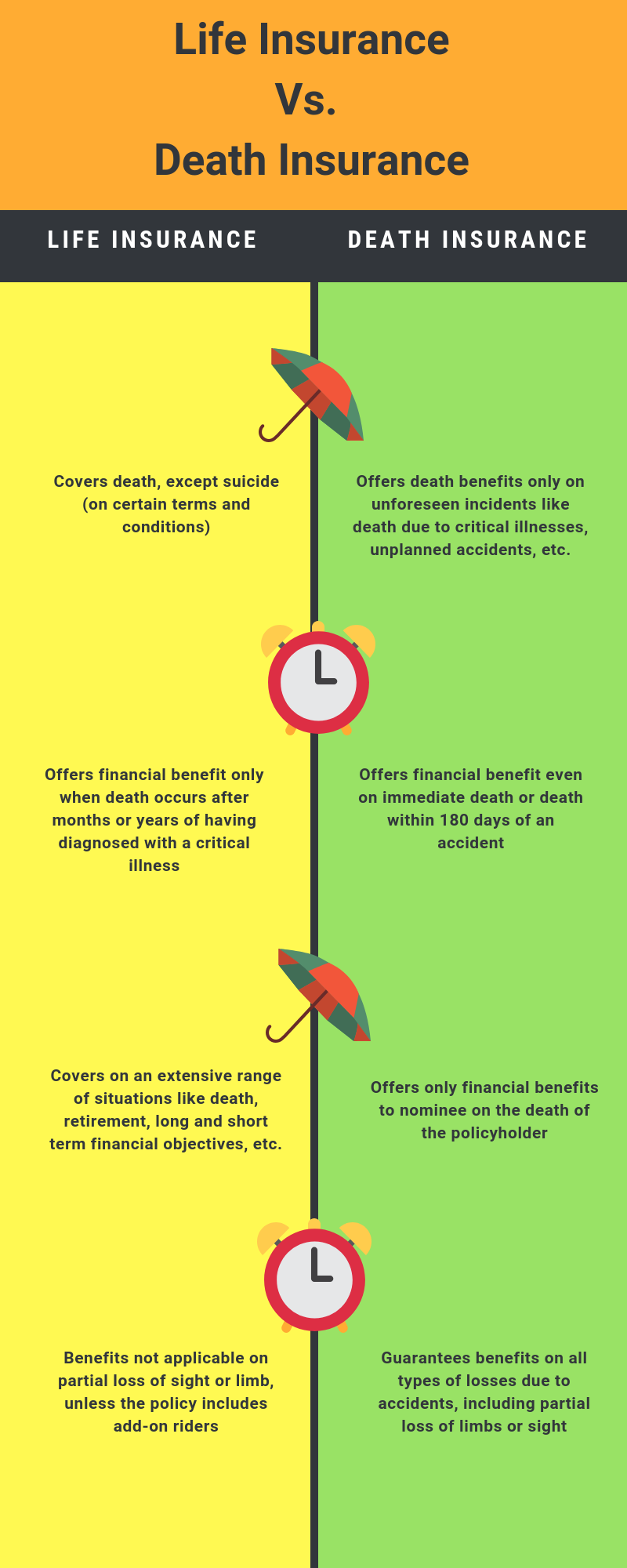

Life Insurance Vs Accidental Death Insurance Explained

What Is The Meaning Of Sum Assured In Insurance Quora

4 Types Of Insurance All Working Singaporean Should Consider Singlife

How To Calculate The Sum Assured And Premium Of Life Insurance Abc Of Money

Bt Insight Should You Go For Arogya Sanjeevani The New Health Plan Businesstoday

What Is Sum Assured Max Life Insurance

Sum Assured Meaning What Is Sum Assured In Insurance Icici Prulife

What Is The Meaning Of Sum Assured In Insurance Quora

Sum Insured In Health Insurance Compare Sum Assured Vs Sum Insured

Sum Insured And Premium Different Words Don T Be Confused

What Is Sum Assured Max Life Insurance

Best Personal Accident Insurance Policies Plans In India 2020 21

12 Points To Remember Before Buying Health Insurance Mymoneysage Blog

Posting Komentar untuk "Sum Insured And Sum Assured Difference"