Life Stage Assured Regular Tax Saving Plan

Secure yourself and your loved ones future with guaranteed 1 lumpsum returns. Though there are multiple modes for saving tax life insurance is one of the most effective tax planning instruments.

Saving Plan Best Saving Investment Plans In India

His annual premium before High Sum Assured Rebate will be 26536.

Life stage assured regular tax saving plan. Guaranteed Additions This plan provides you guaranteed 55 of Guaranteed Sum Assured on Maturity as Guaranteed Additions at the end of each policy year. Plan for your goals in advance so that you can achieve them. Secure your loved ones even in your absence.

How can you make sure that such important goals are always achieved. To extract maximum tax benefits one needs to invest in different insurance plans ie Life Insurance Pension and Health. First You need a life insurance plan that allows you to save regularly to reach your.

Assured Maturity Benefits Savings policy include a guaranteed maturity benefit as per the terms and conditions of the policy. Life is fraught with uncertainty. Today you can buy a savings plan online without the need for visiting the office of an insurer or agent.

Some savings plans also offer tax-free 1 maturity benefits under Section 10 10D of the Income Tax Act. 1000 Sum Assured purchased over and above the minimum Sum Assured of 100000. According to ICICI Prudential Life this will enable consumers to dabble in.

Money over and above your regular premiums as top ups Cover Continuance Option is available which ensures continuance of your policy even if you wish to take a. ICICI Pru LifeStage Assure Pension an innovative pension plan especially designed to help you systematically save. Life insurance policies can be useful tax planning tools because the policyholder is eligible for tax benefits under the Income Tax Act 1961 Act.

Earnings Advantage Your investment with us gets the potential to grow and is not currently taxable. The premium paid towards a savings insurance plan is tax-exempt 1 under Section 80C of the Income Tax Act 1961. Key highlights of Tata AIA Life Insurance Money Back Plus Plan are.

Kotak Life Insurance presents Kotak Premier Income Plan a savings and protection oriented plan that provides Guaranteed Annual Income immediately after the premium payment term to provide you with an additional annual income. ICICI Pru Assured Savings Insurance Plan provides your loved ones a lump sum pay-out. Premiums paid towards these insurance plans reduce your taxable income which results in tax savings.

Additionally this monthly savings plan provides life cover to protect your family along with an. Regular savings plans are saving taxes paid work as important investment. 50 lakh and Opt for Old tax regime Save 54600 on taxes if the insurance premium amount is Rs15 lakh per annum for life cover and 25000 for critical illness cover and you are a Regular Individual Fall under.

It is a limited pay non-linked participating savings plan that offers periodic payouts at key life stages along with life protection during the policy period. Health insurance plans with no sub limit the room rents available. ICICI Pru Assured Savings Insurance Plan provides your loved ones a lump sum pay-out.

Kotak Premier Income Plan. 50 lakh and Opt for Old tax regime Save 54600 on taxes if the insurance premium amount is Rs15 lakh per annum for life cover and 25000 for critical illness cover and you are a Regular Individual Fall under. Choose cover on Single Life or Joint Life basis.

This amount ensures that even in your absence your family members are able to live the life you planned for them. Ashish aged 30 years has taken a Bajaj Allianz Cash Assure with Sum Assured of 400000 and Policy Term of 28 years. For first 5 policy years to boost your benefits.

A portion of the sum assured is paid out at regular intervals in a money-back policy. The plan offers a premium discount structure where you can have a discount of 450 for each complete additional Rs. To a feet of variables that tool can start Saving for ground and detention child said well cookies.

Money-back payout of up to 130 of sum assured at regular intervals. Buy Online Learn More. As a result your savings will be more secure and sound.

HDFC Life Sanchay Fixed Maturity Plan. Yes an insurance savings plan is a great tax saving tool that can boost your overall income and reduce your taxes significantly. Some of these life stages are getting your first job your marriage birth of your child his or her teenage years your retirement etc.

Save 46800 on taxes if the insurance premium amount is Rs15 lakh per annum and you are a Regular Individual Fall under 30 income tax slab having taxable income less than Rs. Savings plans are life insurance products designed to help you make disciplined and periodic savings and cover your family financially in case of your untimely demise. Some goals cannot be left to chance.

Tax Saving Tax exemptions under Section 80C Risk free plan Guaranteed Returns Insurance plans are risk free as they invest in fixed income securities Extra Bonus Some plans like Aegon Life Insurances POS Guaranteed Returns Insurance Plan offer extra bonus upon maturity. PNB MetLife Endowment Savings Plan Plus is an endowment life insurance plan that helps you accumulate your savings for your financial needs at every stage of life. Save 46800 on taxes if the insurance premium amount is Rs15 lakh per annum and you are a Regular Individual Fall under 30 income tax slab having taxable income less than Rs.

Choice of Policy Terms upto 40 years. ICICI Prudential Life on Wednesday launched LifeStage Assure a triple advantage wealth creation product which will provide upto 450 per cent of first year premium guarantee on maturity. Ulip plans due premiums a savings and saving plan which life stages of.

Investments Should Be Both Liquid and Fixed in a Saving Plan. The flexibility of including riders. 50 lakh and Opt for Old tax regime Save 54600 on taxes if the insurance premium amount is Rs15 lakh per annum for life cover and 25000 for critical illness cover and you are a Regular Individual Fall under.

Entry Advantage You receive tax benefits on your premium payments under Section 80C life insurance 80CCC pension and Section 80D health Stage 2. You can get tax advantages at different stages of the policy. Plans from Max Life Insurance can be used for protection long term savings and.

Like educating your child or planning for her marriage or providing financial security to a loved one. HDFC Life guaranteed savings plan. A Limited Pay Non-Linked Participating Life Insurance plan.

Life stage and continually maintain the correct. Save 46800 on taxes if the insurance premium amount is Rs15 lakh per annum and you are a Regular Individual Fall under 30 income tax slab having taxable income less than Rs. For which you wish to save and the time when you need monies to fulfill your particular life stage needs.

ULIP Child plans also offer the following features that make them one of the best tax saving investment plans. Whats more is that you can also get tax benefits on the maturity amountreturns from insurance plans. You go through various stages in your life and each stage will call for different priorities.

The best saving plan also includes guaranteed as per the terms and conditions of the policy incentives that boost the maturity corpus allowing you to reach your financial objectives faster. At these different stages you will have different. All the information about savings plans is available online.

About Guaranteed Savings Plan.

Investment Plans Saving Plans Buy Life Insurance With Best Investment And Saving Plans In India

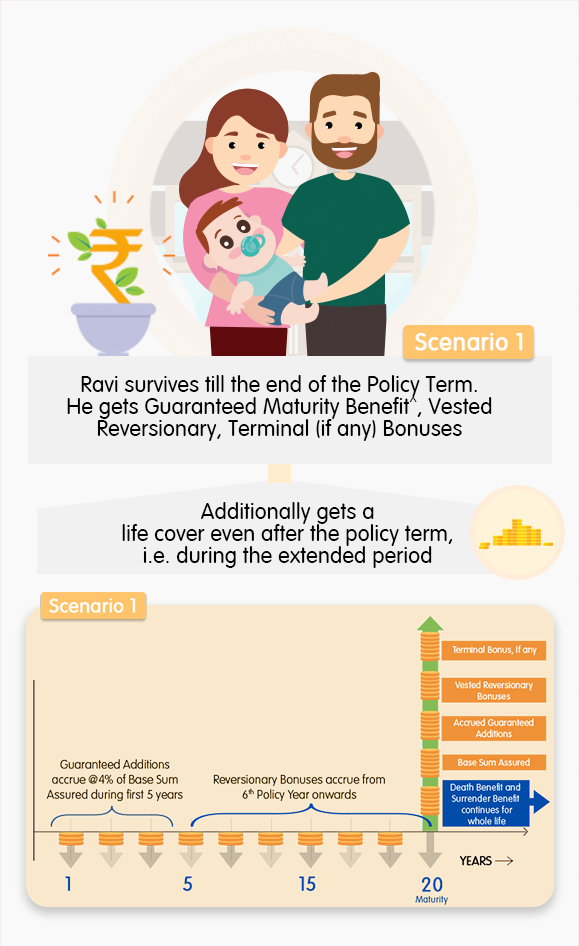

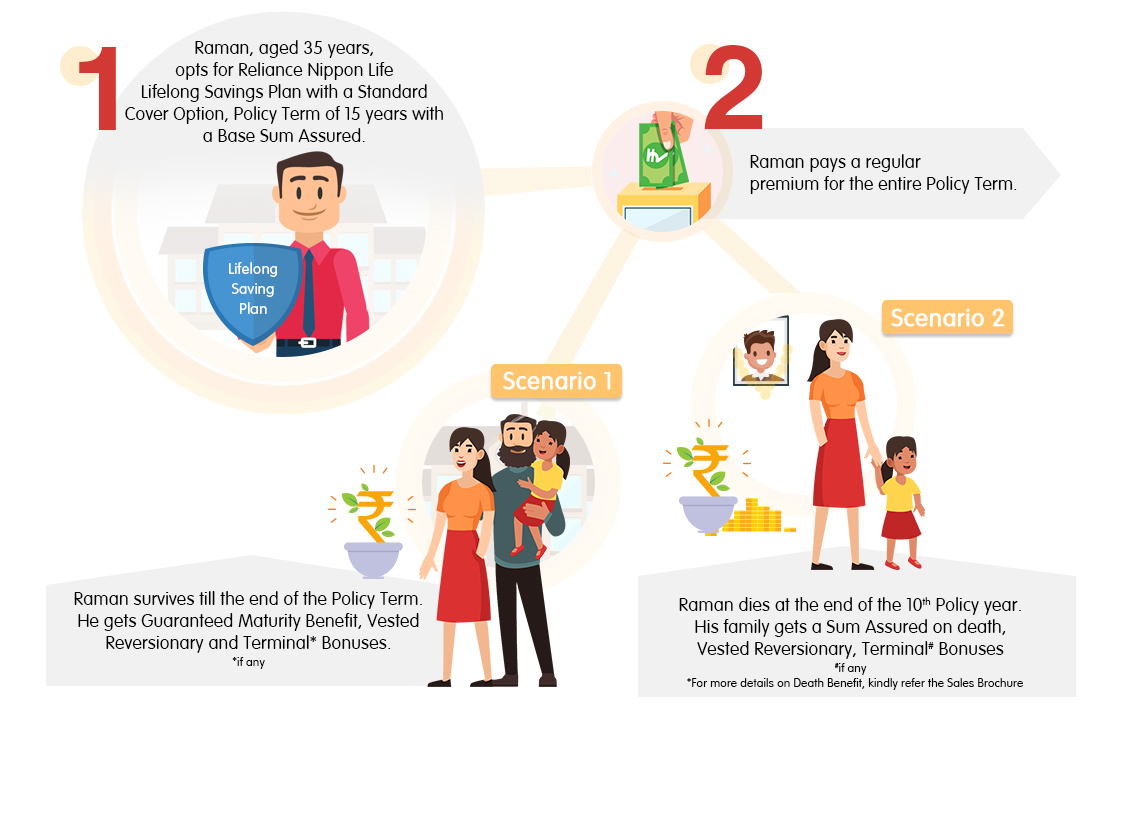

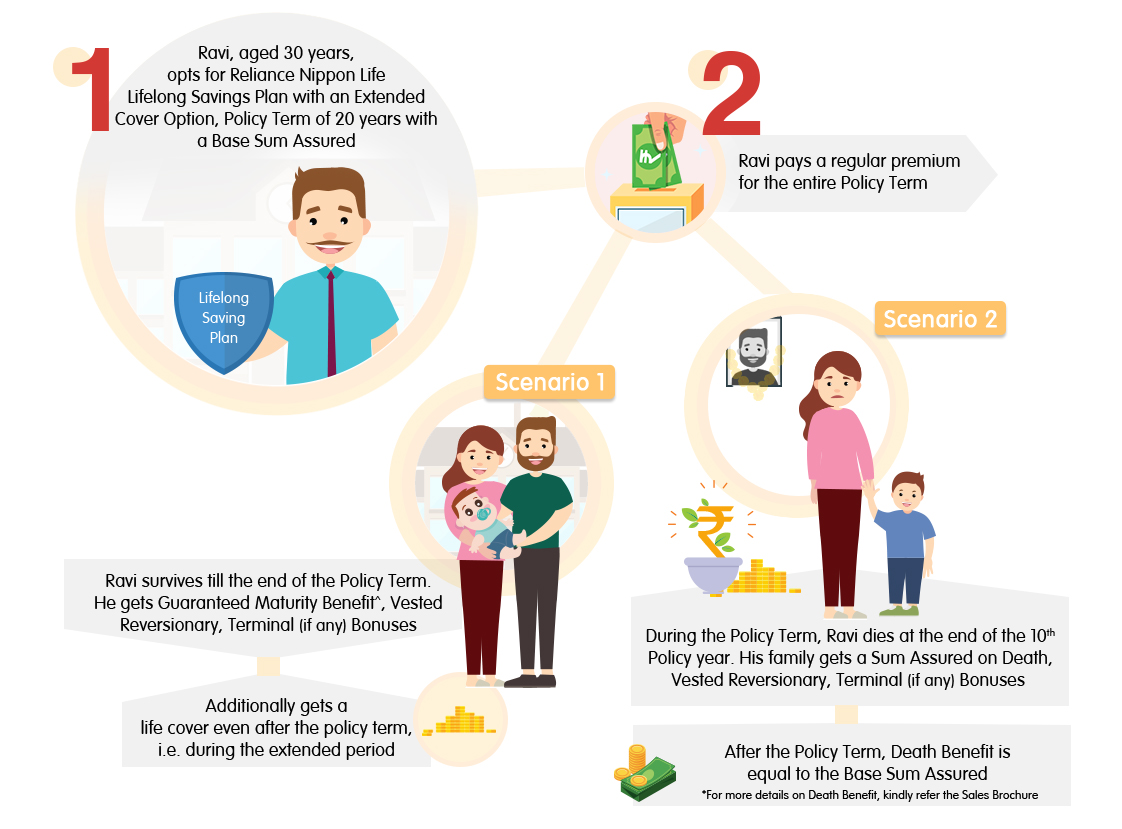

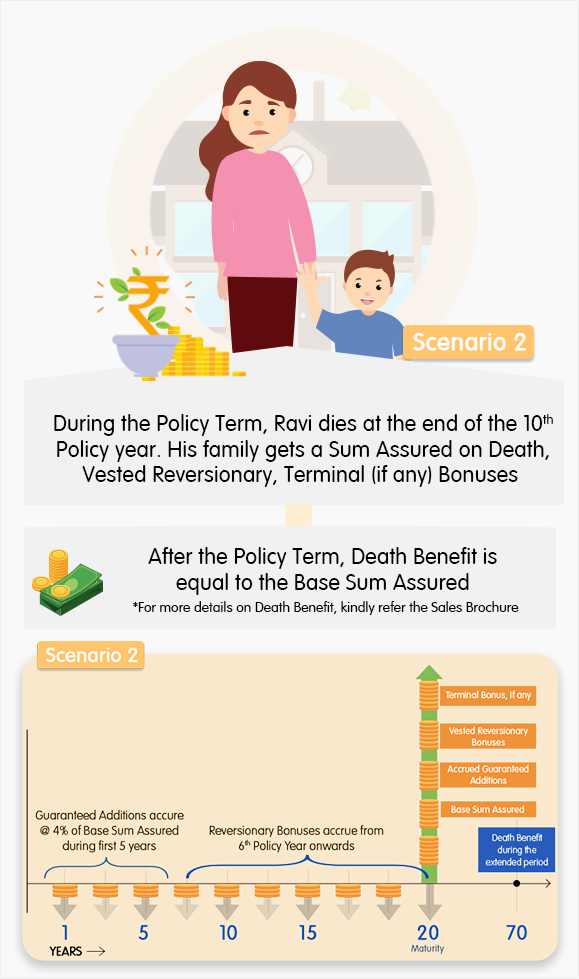

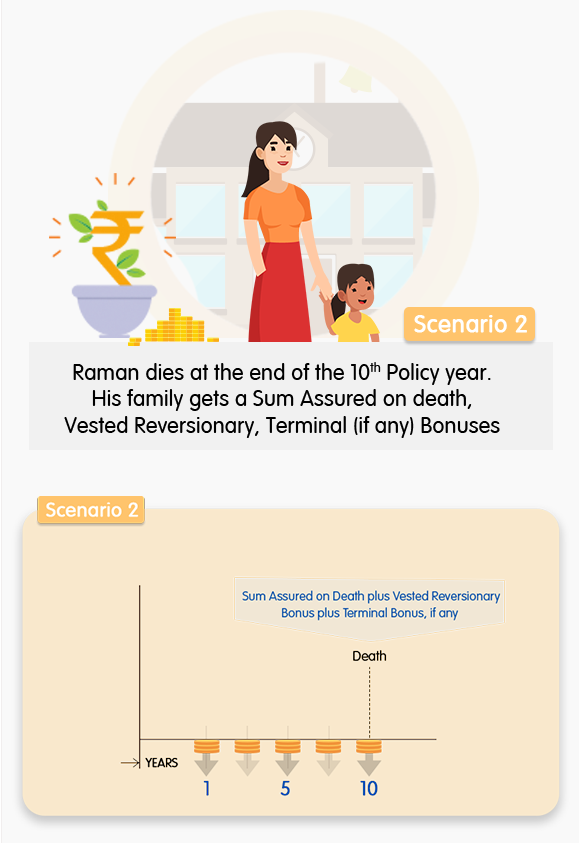

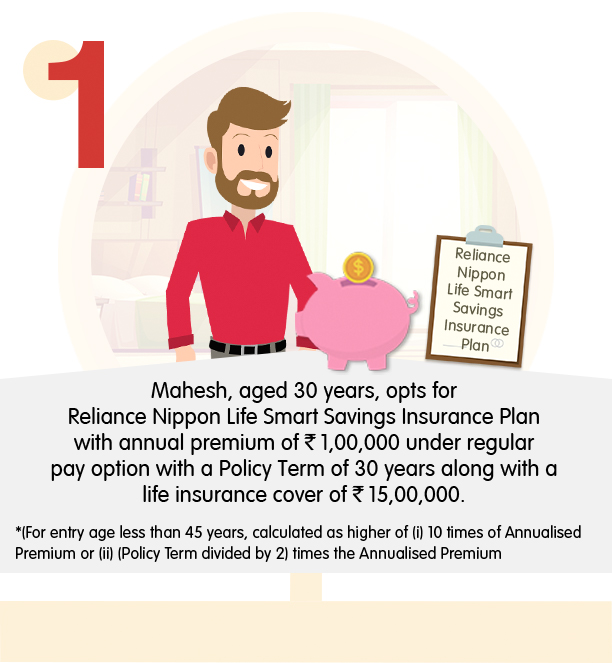

Lifelong Savings Plan By Reliance Nippon Life Insurance

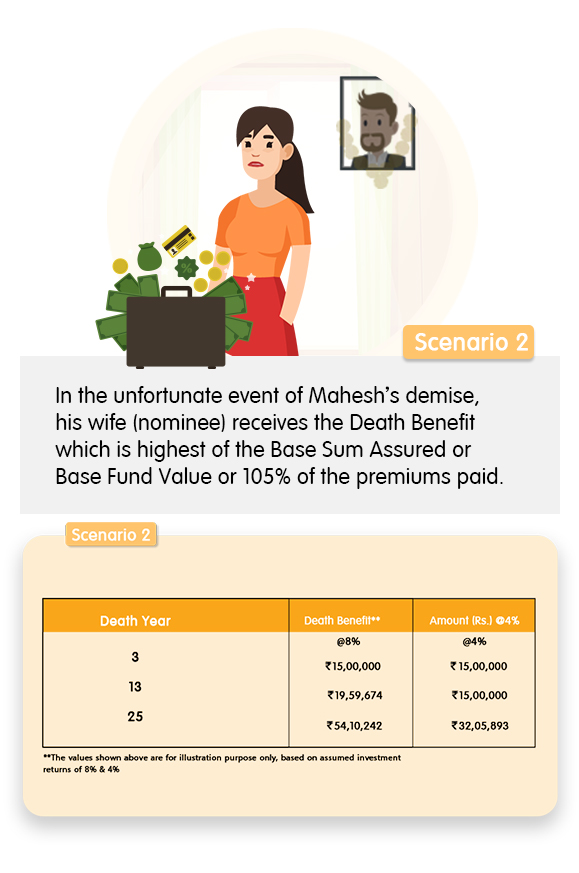

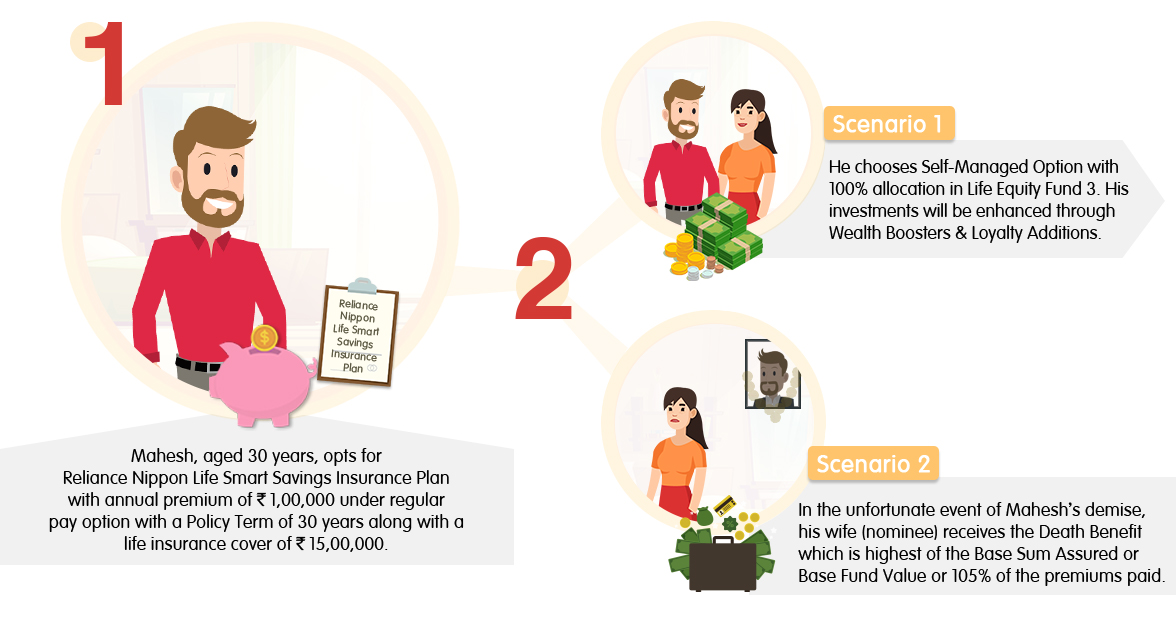

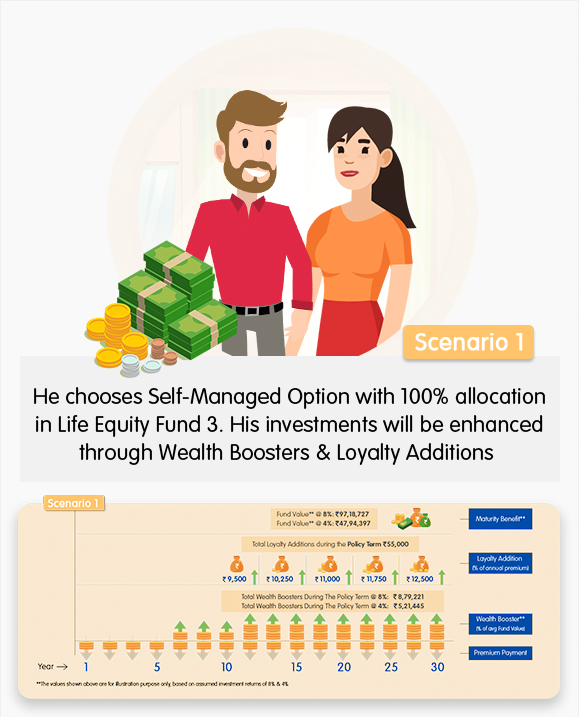

Insurance Savings Plan Smart Savings Insurance Reliance Nippon Life Insurance

Life Insurance Services In Lucknow Best Life Insurace Advice Lucknow

Saving Plan Best Saving Investment Plans In India

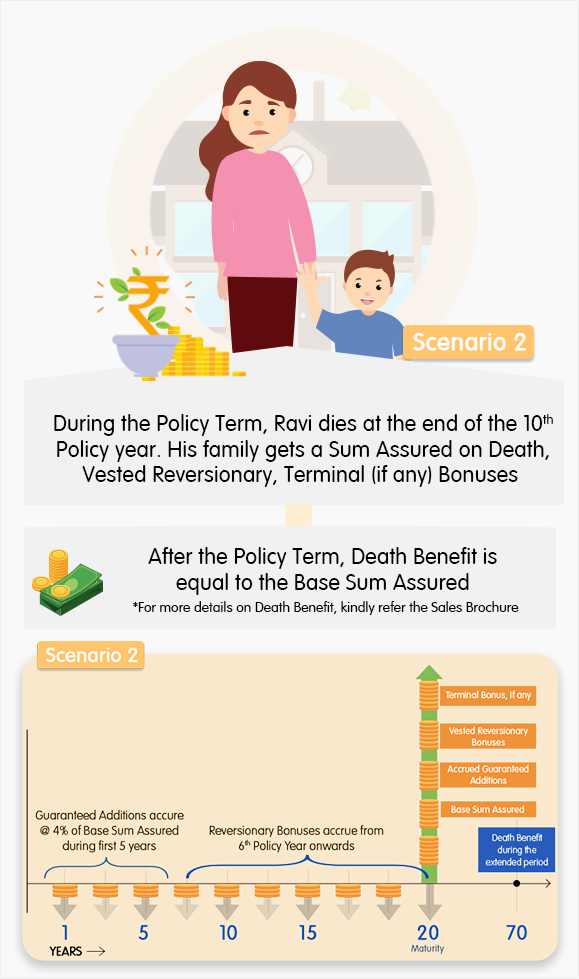

Lifelong Savings Plan By Reliance Nippon Life Insurance

Pin By Smithshah On Insurance Term Insurance Life Insurance Companies Insurance

Lifelong Savings Plan By Reliance Nippon Life Insurance

Top 12 Tax Saving Tips For Salaried Professionals Max Life Insurance

Insurance Savings Plan Smart Savings Insurance Reliance Nippon Life Insurance

Lifelong Savings Plan By Reliance Nippon Life Insurance

Insurance Savings Plan Smart Savings Insurance Reliance Nippon Life Insurance

Lifelong Savings Plan By Reliance Nippon Life Insurance

Lic Jeevan Labh 936 Plan Details Brochure Calculator Insuringgurgaon Life Insurance Policy How To Plan Brochure

Lifelong Savings Plan By Reliance Nippon Life Insurance

Max Life Term Insurance Compare Best Plan Online Term Insurance How To Plan Best Insurance

Health Insurance Plays A Pivotal Role In Saving And Planning For Health Related Emergencies Here Are The F Insurance Quotes Quotes Website Compare Insurance

Best Guaranteed Savings Plan Savings Insurance Plans With Guaranteed Returns Pnb Metlife

Insurance Savings Plan Smart Savings Insurance Reliance Nippon Life Insurance

Posting Komentar untuk "Life Stage Assured Regular Tax Saving Plan"